Calculating the cost of poor stock management

Many small businesses unknowingly lose significant money because of how they manage their inventory. This goes beyond just missing items, extending to lost sales, wasted time, and unnecessary costs.

Understanding these hidden losses is the first step to improving your bottom line. This guide will show you how to estimate the real cost of poor stock management in simple terms.

If you are reading this over email, there is a hidden cost calculator at the bottom of the article.

Improper stock processes directly impact your profits. Let's break down where these losses occur and how to think about their value.

Lost Sales

The obvious cost

When a customer wants to buy something, but you're out of stock. They might go to a competitor, or simply decide not to buy.

How to estimate:

First, identify common stockouts. Which products do you run out of most often? Next, estimate lost opportunities. For each stockout, how many sales do you think you missed?

"We usually sell 10 of these per week, but we were out for 2 weeks, so maybe 20 sales were lost."

Finally, calculate potential revenue by multiplying the number of lost sales by the average selling price of that item.

Example: If you missed 20 sales of an item that sells for $50, you lost $1,000 in potential revenue.

Excess Costs

Holding stock is expensive

Having too much stock might seem safe, but it's expensive.

How to estimate:

Start by calculating storage costs. This is the cost per square foot of your warehouse or storage space. If you have slow-moving items taking up a lot of space, that's a direct cost.

"This pallet of old stock takes up 10 sq ft, costing us $50/month in rent for that space."

Also consider tied-up cash. Every dollar in excess inventory is a dollar you can't use for other things, like marketing or new products.

If you had to borrow money for that stock, you're paying interest.

Factor in obsolescence or damage. Products can become outdated, damaged, or expire. The cost here is the original purchase price of those items.

Example: If you have $10,000 worth of old stock sitting for a year, and your storage costs are 1% of inventory value per month, that's $1,200 in storage alone, plus the risk of never selling it.

Wasted Time

Time is money

Time is money, and inefficient processes waste a lot of it.

After calculating the hours your staff spend correcting mistakes, searching for misplaced items, or manually entering data, it's incredible how much inefficiency is found.

How to Estimate:

Track time spent by asking your team to estimate how much time they spend on correcting wrong orders or shipments, searching for items in a disorganized warehouse, manually updating stock counts or creating purchase orders, and handling customer complaints due to stock issues.

Then, calculate labor cost by multiplying these hours by the average hourly wage of the staff involved.

Example: If your team spends 5 hours a week fixing stock errors (at $20/hour), that's $100/week, or $5,200 per year, just on error correction.

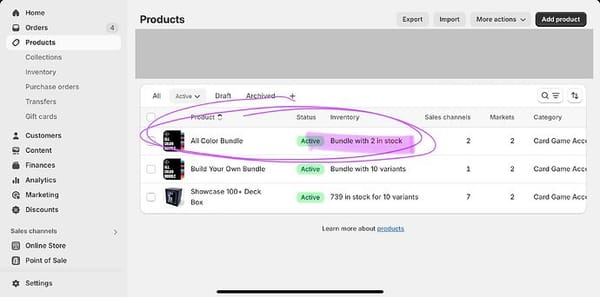

Missing Items

Direct loss of product

Inventory that disappears due to theft, damage, or simply being miscounted and lost.

How to Estimate:

Compare records to a physical count. When you do a physical stocktake, compare it to your recorded inventory levels.

The difference is your shrinkage. Then, calculate the value by multiplying the number of missing items by their cost (what you paid for them).

Example: If you find 5 items missing that cost you $30 each, that's $150 in direct loss.

Your Total Hidden Cost

Estimate Your Hidden Stock Costs

1. Lost Sales (from Stockouts)

2. Excess Costs (Overstocking)

3. Wasted Time Costs

4. Missing Items (Shrinkage)

Understanding these hidden costs is about gaining insight.

Once you see the real financial drain caused by improper stock processes, you'll recognize that investing in better solutions is a strategic move.

Looking for frictionless inventory management? Check out Lecxa!